Homebuilder Shares Hang In Balance As Credit-Stretched Consumers Await Rate Cuts

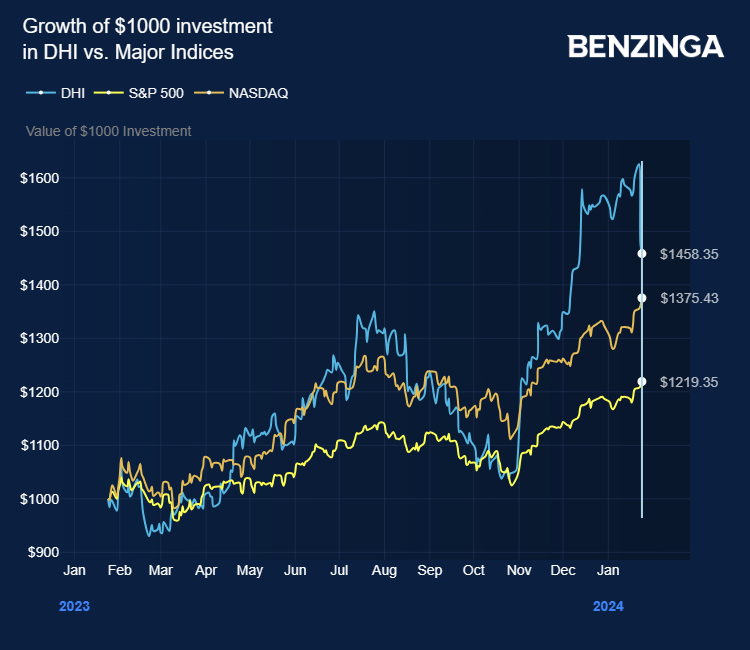

Shares in homebuilders fell sharply this week following fourth-quarter results from D.R. Horton Inc (NYSE:DHI) which showed the company had to pile on the sales incentives to generate its top-line growth.

Thus, even though the biggest house builder in the U.S. generated annual revenue growth of 6.4%, net earnings and gross margins fell as the company cut deep discounts into its sales prices.

Tepid Analyst Response To D.R. Horton Results

Analysts were lukewarm on the results. While higher sales showed some buoyancy exists in the U.S. housing market, uncertainty surrounding buyer affordability remains as mortgage rates stay relatively high and the interest rate outlook becomes more clouded.

Keefe, Bruyette and Woods reduced its 2024-2025 growth estimates, but maintained an Outperform rating, saying “the backdrop remains in line with our ‘sideways’ thesis.”

Wedbush rated the stock at Neutral with a price target of $115. Analyst Jay McCanless said: “We anticipate the mortgage rate volatility and what we believe was a competitive pricing environment during the quarter may have contributed to the earnings miss.”

Since Tuesday’s earnings report, …

Full story available on Benzinga.com

Related posts:

- US Stocks Pause As Treasury Yields, Dollar Surge On Trimmed Fed Rate Cut Bets: What’s Driving Markets Tuesday?

- Mixed Bag For Constellation Brands: Earnings Reveal Strong Profits Amid Sales Forecast Cut

- Apple, Nvidia Supplier TSMC Records 19% Q4 Profit Drop But Exceeds Market Expectations

- Amid Competition From BYD, Elon Musk Warns Of Chinese Automakers Potential To ‘Demolish’ Rivals