Lululemon Gains on Q1 Earnings Beat, Raised FY24 EPS View

Lululemon athletica inc. (NASDAQ: LULU) reported first-quarter fiscal 2024 results, wherein revenues and earnings surpassed the Zacks Consensus Estimate and improved year over year. The results were driven by strong momentum in the international business as its products resonate well with customers. Innovative product offerings and progress on optimizing the U.S. product assortments also aided the results.

The company has been on track with the Power of Three X2 growth plan. LULU outlined the guidance for the fiscal second quarter. Moreover, it reiterated the revenue guidance but raised its EPS view for fiscal 2024.

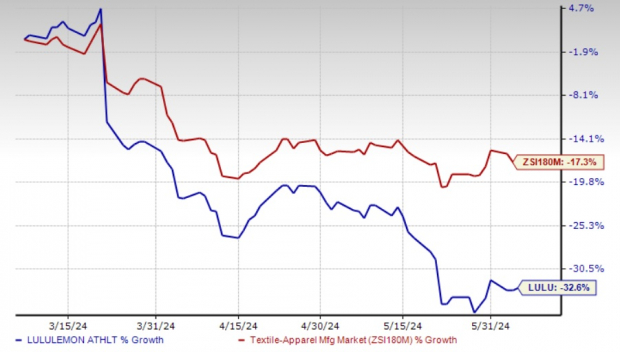

Shares of lululemon gained 9.7% in the after-market trading session on Jun 5, mainly on strong first-quarter fiscal 2024 results and a solid international performance. The Zacks Rank #4 (Sell) company’s shares have lost 32.6% in the past three months compared with the industry’s decline of 17.3%.

Image Source: Zacks Investment Research

Q1 Details

lululemon’s fiscal first-quarter earnings of $2.54 per share increased 11.4% year over year and beat the Zacks Consensus Estimate of $2.38.

The Vancouver, Canada-based company’s quarterly revenues advanced 10% year over year to $2.209 billion and outpaced the Zacks Consensus Estimate of $2.198 billion. On a constant-dollar basis, net revenues improved 11% year over year in the fiscal first quarter. Net revenues grew 3% in the Americas (up 4% on a constant-dollar basis) and 35% internationally (up 40% on a constant-dollar basis).

Total comparable sales rose 6% year over year and 7% on a constant-dollar basis. Comparable sales in the Americas were flat year over year. Internationally, comparable sales increased 25% and 29% on a constant-dollar basis.

In the store channel, the company’s total sales increased 12%. Digital revenues improved 8% year over year and contributed 41% to the total revenues.

Gross profit improved 11% year over year to $1.3 billion. Also, the gross margin expanded 20 basis points (bps) to 57.7%, driven by a 120-bps rise in the product margin due to lower product costs, airfreight costs and inventory provisions, offset by a 50-bps increase in markdowns. The increase in product margin was partly negated by 70-bps deleverage on fixed costs and 30-bps deleverage on foreign exchange. …

Full story available on Benzinga.com