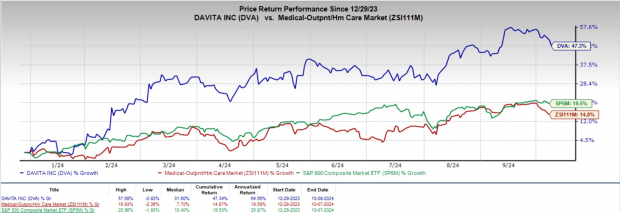

DaVita Stock Gains 47.3% Year to Date: What’s Behind the Rally?

DaVita, Inc. (NYSE: DVA) has witnessed strong momentum year to date, with its shares up 47.3% compared with the industry’s growth of 14.8%. The S&P 500 composite has risen 19.5% in the same period.

DaVita, carrying a Zacks Rank #2 (Buy) at present, is witnessing an upward trend in its stock price, prompted by the company’s business model. The optimism, led by a solid second-quarter 2024 performance and the acquisition of dialysis centers, is expected to contribute further.

DaVita is a leading provider of dialysis services in the United States to patients suffering from chronic kidney failure, also known as end-stage renal disease (ESRD). The company operates kidney dialysis centers and provides related medical services, primarily in dialysis centers and contracted hospitals across the country. Its services include outpatient dialysis services, hospital inpatient dialysis services and ancillary services such as ESRD laboratory services and disease management services.

Image Source: Zacks Investment Research

Catalysts Driving DaVita’s Growth

The rally in the company’s share price can be attributed to the strength of its dialysis and related lab services. The optimism led by a solid second-quarter 2024 performance and robust business potential are expected to contribute further.

DaVita is experiencing significant growth driven by its patient-centric care approach, leveraging its kidney care services platform …

Full story available on Benzinga.com

Related posts:

- Charles Schwab’s ‘Transition Year’: Analysts Break Down Q4 Earnings Beat

- AI Drives Tech Rebound, Oil Soars, Bitcoin Tumbles: What’s Driving Markets Thursday?

- General Electric’s Soft Guidance Sparks Concerns As GE Aerospace And GE Vernova Spin-Off Nears

- Why Aerospace And Defense Giant General Dynamics Shares Are Shooting Higher Today