Should You Retain Markel Group Stock in Your Portfolio?

Markel Group Inc. (NYSE: MKL) has been gaining momentum on the back of new business volume, strong retention levels, an improving rate environment, higher interest income on cash equivalents, strategic buyouts and favorable growth estimates.

Growth Projections

The Zacks Consensus Estimate for Markel Group’s 2024 revenues is pegged at $14.95 billion, implying a year-over-year improvement of 4.6%.

The consensus estimate for 2025 earnings per share and revenues indicates an increase of 21% and 5.6%, respectively, from the corresponding 2024 estimates.

Earnings have grown 46.2% in the past five years, better than the industry average of 14.4%.

Earnings Surprise History

Markel Group has a decent earnings surprise history. It beat estimates in two of the last four quarters and missed twice, the average being 33.41%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 and 2025 has moved 2% and 1.9% north, respectively, in the past 60 days, reflecting analyst optimism.

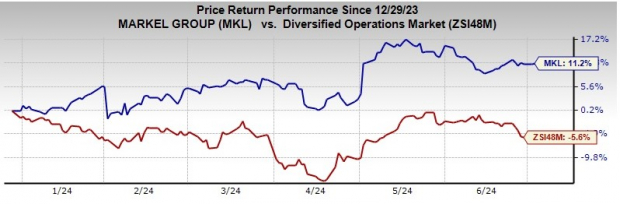

Zacks Rank & Price Performance

MKL currently carries a Zacks Rank #3 (Hold). The stock has gained 11.2% against the industry’s decline of 5.6% year to date.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Markel Group’s trailing 12-month ROE was 11.2%, up 310 basis points year over year. ROE reflects its efficiency in using its shareholders’ funds.

Business …

Full story available on Benzinga.com

Related posts:

- Charles Schwab’s ‘Transition Year’: Analysts Break Down Q4 Earnings Beat

- AI Drives Tech Rebound, Oil Soars, Bitcoin Tumbles: What’s Driving Markets Thursday?

- General Electric’s Soft Guidance Sparks Concerns As GE Aerospace And GE Vernova Spin-Off Nears

- Why Aerospace And Defense Giant General Dynamics Shares Are Shooting Higher Today